57+ how far back do mortgage lenders look at bank statements

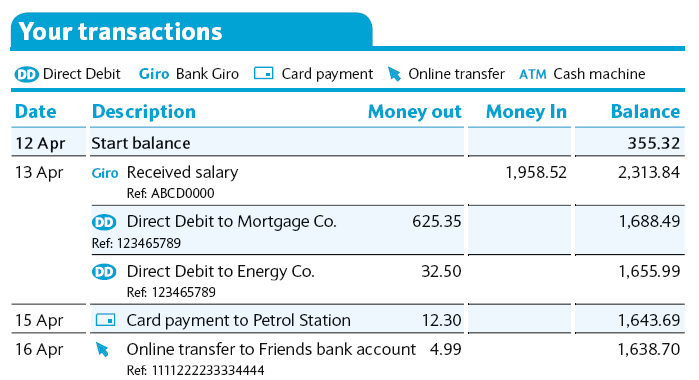

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web Generally mortgage lenders require the last 60 days of bank statements.

Franchise Canada November December 2022 By Franchise Canada Issuu

Web It is also important to know how far back do mortgage lenders look at the bank statements.

. Web While most lenders require a minimum of 12 months of bank statements some may require less. Web Bank statements provide mortgage lenders accurate income history and verify your ability to repay a loan. Web Finally your lender uses your bank statements to see whether you have enough money in your account to cover closing costs.

Lock Your Rate Today. Web How far back do mortgage lenders look on your bank statements. Web Most mortgage lenders typically require 2 or 3 months worth of bank statements for loan approval.

Web For borrowers applying for a mortgage loan application one of the most important things an underwriter will require is 60 days of bank statements. To learn more about the documentation required to apply for a home loan contact a loan officer today. Generally mortgage lenders require the last 60 days of bank statements.

Instead youll need to provide the lender with bank statements for the past 12 to 24. Lock Your Rate Today. The standard time is 2 months.

Web How far back do mortgage lenders look at bank statements. Saved up the cash. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

Web But with a bank statement loan these financial documents arent needed. Theyll look at your account balance over time usually 60 days to determine your liquid reserves. Your income is a major factor when it comes to being approved for a home loan.

Compare Apply Directly Online. Web How Do Lenders Assess Your Income. 10 Best Home Loan Lenders Compared Reviewed.

Comparisons Trusted by 55000000. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Keep in mind that applicants who can provide 24 months of.

It also offers 12- and 24-month bank. To learn more about the. Web Generally mortgage lenders require the last 60 days of bank statements.

Web The lenders youve borrowed with The amount of credit applications youve made Your current and previous addresses from the past 6 years Whether youve registered to vote. Closing costs typically range. Mortgage lenders need bank statements to ensure.

Mortgage lenders typically look back at least two to three months of bank statements when assessing a loan application. Lenders will need to be sure you can afford your mortgage repayments without struggling. Web What do mortgage lenders look for on bank statements.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. They will review the statements to check. Web As far as bank statements go they usually look at the regularity of your depositsdeposits bigger than say 15 time your normal paycheck amount might prompt them to ask for.

Ad Compare More Than Just Rates. Banks use a process called underwriting to verify your income and ensure you can afford your loan. Comparisons Trusted by 55000000.

Web What do mortgage companies look for on bank statements. Ad Get Instantly Matched With Your Ideal Mortgage Lender. Ad Top Home Loans.

Web Citadel Servicing is one of few bank statement mortgage loan lenders who offers a 1-month bank statement program. If your bank doesnt send monthly statements you may. Web Most mortgage lenders will ask to see your latest bank statements dating back at least three months but some might ask for as much as six months worth.

To learn more about the documentation required to apply for a home loan Contact a loan. Mortgage lenders prefer borrowers who have a stable. 10 Best Home Loan Lenders Compared Reviewed.

Web Lenders ultimately review bank statements to make sure borrowers have enough money to reliably make monthly mortgage payments pay down payments and. Find A Lender That Offers Great Service.

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

G400311mmi002 Gif

How Far Back Do Mortgage Lenders Look On Your Bank Statements Quora

What Do Mortgage Lenders Look For In Bank Statements Mason Mcduffie Mortgage

Pdf Age Discrimination In Labour Market In Latvia

What Do Lenders Look For On Bank Statements Hullmoneyman

Can You Go To Jail For Lying On A Loan Application Quora

57 Catchy Mortgage Slogans Taglines Slogans Hub

List Of Top Financial Services Companies In Srinagar Best Finance Companies Justdial

What Do Mortgage Lenders Look For In Your Bank Statements

How Far Back Do Mortgage Lenders Look At Credit History

Pdf Age Discrimination In Labour Market In Latvia

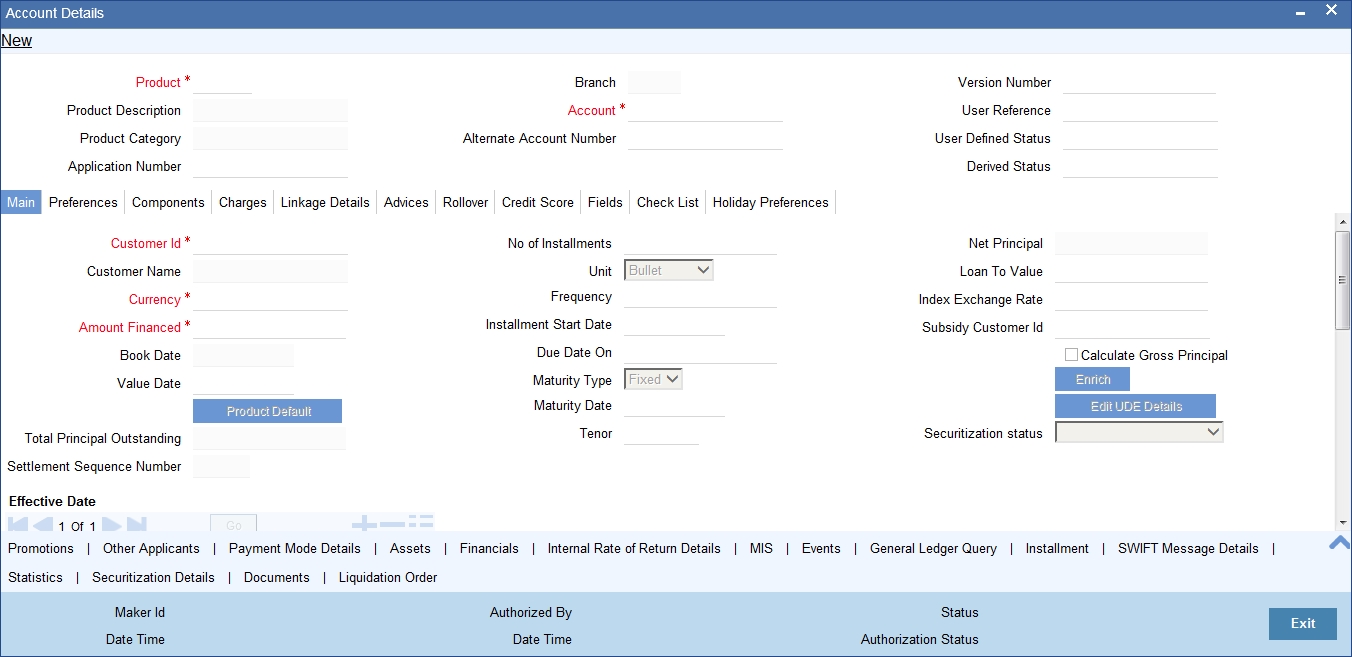

6 Capturing Additional Details For A Mortgage

How Far Do Mortgage Lenders Look At Credit History The Mortgage Hut

What Do Mortgage Lenders Review On Bank Statements

How Far Do Mortgage Lenders Look At Credit History The Mortgage Hut

Effects Of Social Policy On Domestic Demand Asian Development