23+ assumable fha mortgage

Discover 2023s Best FHA Lenders. Web FHA mortgage.

Fha Loans Prepayments And Due On Sale Clauses

Get Pre- Approved Today Be 1 Step Closer to Your Home.

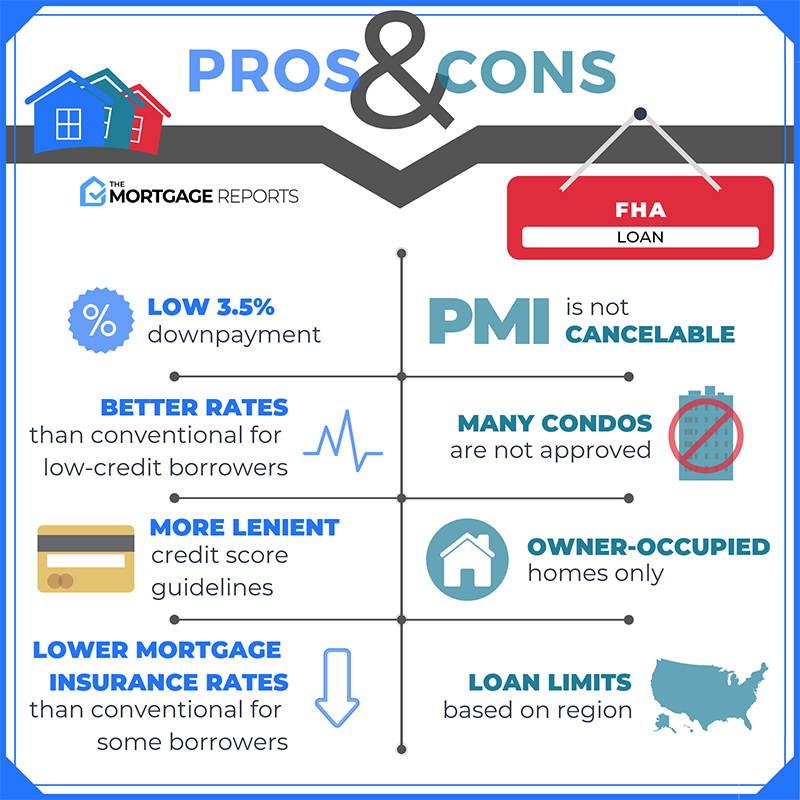

. However FHA has placed certain restrictions on the assumability of FHA-insured mortgages originated since 1986. Find A Great Lender Today. Web An FHA loan is a government-backed mortgage loan that can allow you to buy a home with looser financial requirements.

Web Loan assumptions are a bit different than a new purchase home loan application though the borrower must be able to afford the loan in both cases. Web Homebuyers can be interested in assuming a mortgage when the rate on the existing loan is significantly lower than current rates. Find A Great Lender Today.

According to our mortgage calculator which you can use to model your own. You may qualify for an FHA loan if you. Web Mortgage insurance is required on all FHA loans even if you put 20 down but the amount and duration vary.

Web All FHA insured mortgages are assumable. Web Save Big Money with FHA Assumable Mortgages. Web In order to be assumable a mortgage contract usually has to contain a clause that allows for this special type of sale and gives the lender the right to.

With Low Down Payment Low Rates An FHA Loan Can Save You Money. Web An assumable mortgage is a type of financing arrangement whereby an outstanding mortgage and its terms are transferred from the current owner to a buyer. HUD Homes USA Can Help You Find the Right Home.

Ad Compare Lenders To Get Personalized FHA Mortgage Terms Rates. Ad First Time Homebuyers. Discover The Answers You Need Here.

A buyer needs a FICO Score of 640 or. Web If youre offered an assumable mortgage at 26 youd likely be over the moon. The home must undergo an FHA appraisal and meet.

The short answer is that yes in most cases with lender participation you may be able to assume an existing FHA home loan from the original borrower. Web An assumable mortgage is a mortgage loan that another borrower can take over while keeping the original terms and conditions which is sometimes better than. Ad Get the Latest Foreclosed Homes For Sale.

Web FHA loan rules in HUD 40001 state Assumption refers to the transfer of an existing mortgage obligation from the current borrower to the assuming borrower. For example if the seller has a 225 interest. Signup Now To Get a 1 Trial.

To assume an FHA mortgage buyers must have a FICO Score of 580 or higher. FHA Pros Industry Leaders in helping agents sellers buyers and lenders with advance data technology MLS assumption. Ad Compare Lenders To Get Personalized FHA Mortgage Terms Rates.

Assumable Mortgage What It Is And How It Works Myticor

What Is An Assumable Mortgage The Complete Guide Cc

Advantages Of A Fha Mortgage In 2023

Assumable Mortgage Is It A Good Way To Beat High Interest Rates

Are Va Loans Assumable A Hidden Benefit To Your Va Loan

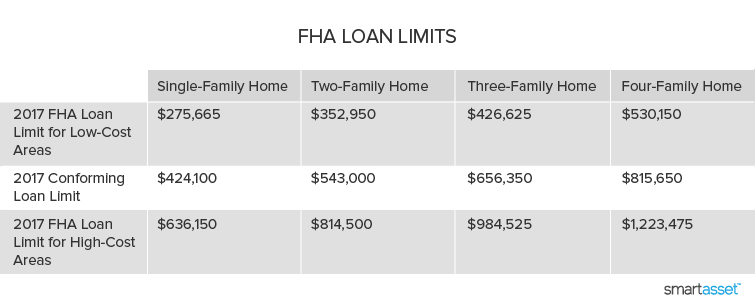

Fha Loan Limits 2023 Update With County Maximums Smartasset Com

Fha Loans Everything You Need To Know

What To Know About Fha Loan Assumptions

Assumable Mortgages Save The Day Amidst Rising Interest Rates Mortgagedepot

2023 Fha Loan Guide Requirements Rates And Benefits

Assumable Mortgage What Is It Why Is This Loan Becoming Attractive

Fha Loan Guide Credit Score Income Requirements Pros Vs Cons Self Inc

What Is An Assumable Mortgage And Why Would You Need One Amplify Cu

Assumable Loans Everything You Need To Know Youtube

When Is An Fha Loan Assumable Fha News And Views

Assumable Mortgages Guide Buying A Home With Usda Fha And Va Loans

Which Mortgage Loans Are Assumable Jvm Lending